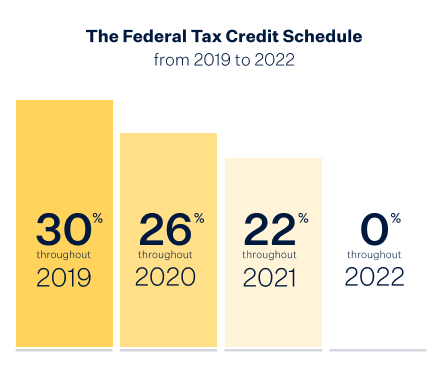

The federal solar tax credit gives you a dollar-for-dollar reduction against your federal income tax. The 26% tax credit applies as long as the solar energy system is installed by December 31, 2020. Starting in 2021, the value of the tax credit will step down to 22%.

Florida property tax exemption

Homeowners understand the value of property tax exemptions, so it’s good news that Florida is offering a tax exemption for residential solar systems.3 And since purchased solar systems may increase the value of your home by up to $15,000 on average,4 you’ll get even more bang for your buck if you decide to move.

Florida net meterings means you win!

Net energy metering is one of Florida’s best solar programs.2 Not only does it offer electric companies a more sustainable source of power, it gives you even more chances to save on your electricity bill.

Here’s how it works: if your home solar system produces more energy than you need, your utility will buy that surplus energy from you and pay you in the form of energy credits. That way, you can put those credits towards your electricity bill for times when you’ve needed to use energy from the grid. You can expect this to happen at nighttime or on particularly cloudy days. Basically, you can bank your solar energy for when you need it most. Learn more about net metering.